The Taiwan New Bank's Wealth Management Team held the "2025 Investment Trend Forum" today, with the theme of "Investment Prospects in Global Movement". Li Dongyu, chief economics scholar of Taiwan New Light Financial Holdings, said that Taiwan's stock market will be "a lot in the short" this year, and waiting for every blowout is to enter the market to buy points. As for Taiwan's tax 20% covers terms of 232, it is quite good to talk about it from the discussion logic.

Taiwan New Bank General Manager Lin Shuzhen said that this year, it will be suitable for the merger of Taiwan New Bank and Xinguang Financial Holdings to become "Taixin New Guang Financial Holdings", becoming the fourth largest financial holding company in Taiwan. In the future, it will cooperate with banks, insurance, securities, investment and other subsidiaries to comprehensively upgrade wealth management services through group resources and channel advantages.

Li Fangyu said that there are two major major axes in the Taiwan Stock Exchange this year. The first is that 2025 is the bulls in the short position. The spots from the beginning of the year to the end of the year will show a rise and fall. However, when investing in the personal area, you will feel the ups and downs. This is a blowout for the Taiwan Stock Exchange. The second is that every blowout is a buying point, such as the 4/3 tax liberation day, or the opening of the market today will fall by nearly 400 points.

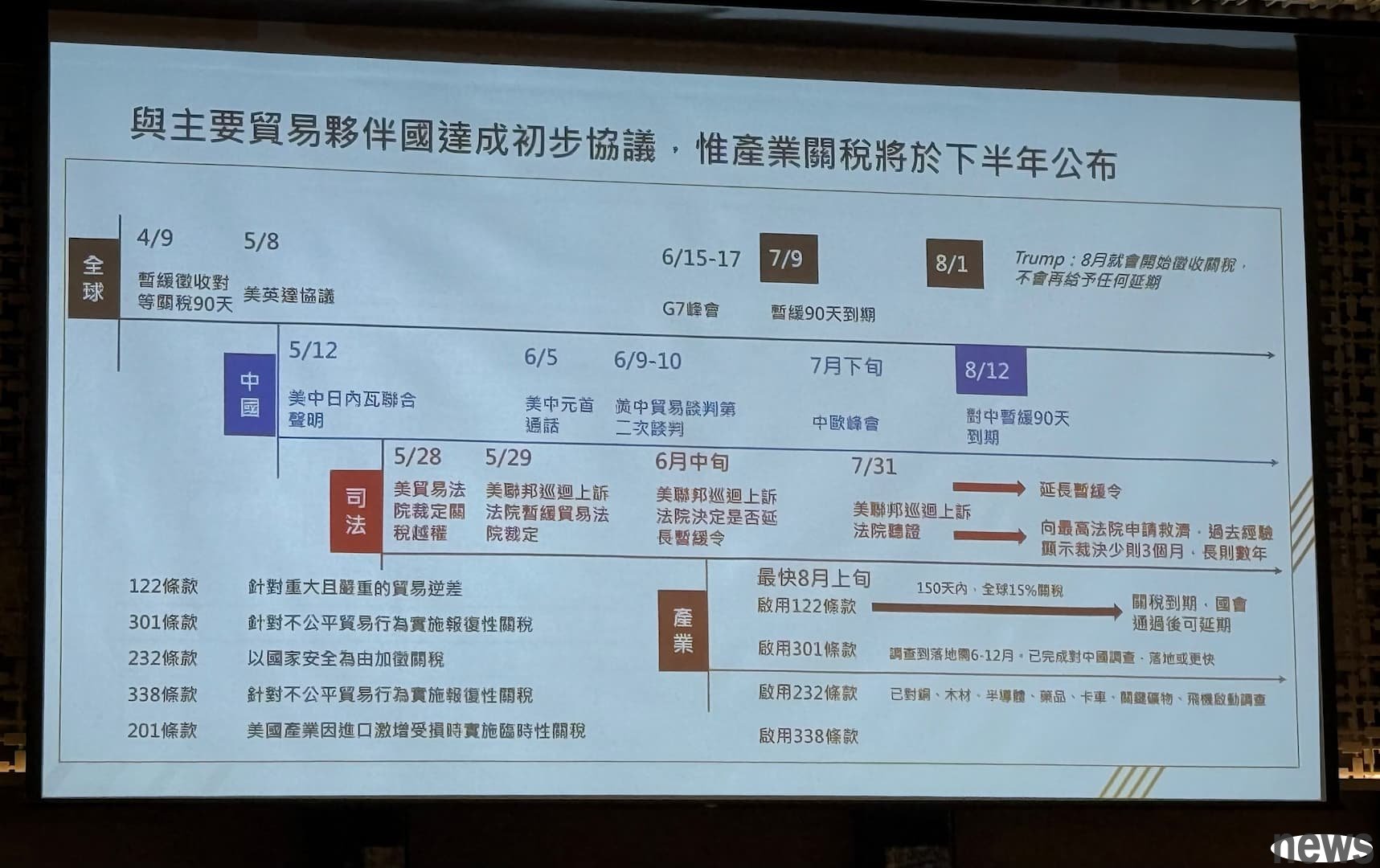

Li Fangyu pointed out that Taiwan's 20% taxes are finally released, which at first glance is very high compared with Japan and South Korea, but Japan and South Korea do a lot of benefits, including market opening and US investment. For Taiwan, it is actually not so important for taxes such as other taxes. On the contrary, the 232 clause is very important for semiconductor industry. Therefore, the verdict team currently says that it will talk with the 232 clause. From the verdict logic, it is quite good.

In terms of exchange rate, Li Fangyu pointed out that the market forecast to fall to 35 yuan at the beginning of the year, and the result was that it would rise to 15 yuan in April. No country's currency would go like this, so no matter where the New Taiwan Coin rose, it will eventually be bought back, because the New Taiwan Coin Exchange rate this year is an event-type driver, and it is estimated that it will remain at a quake between 28.5 and 30 yuan this year.

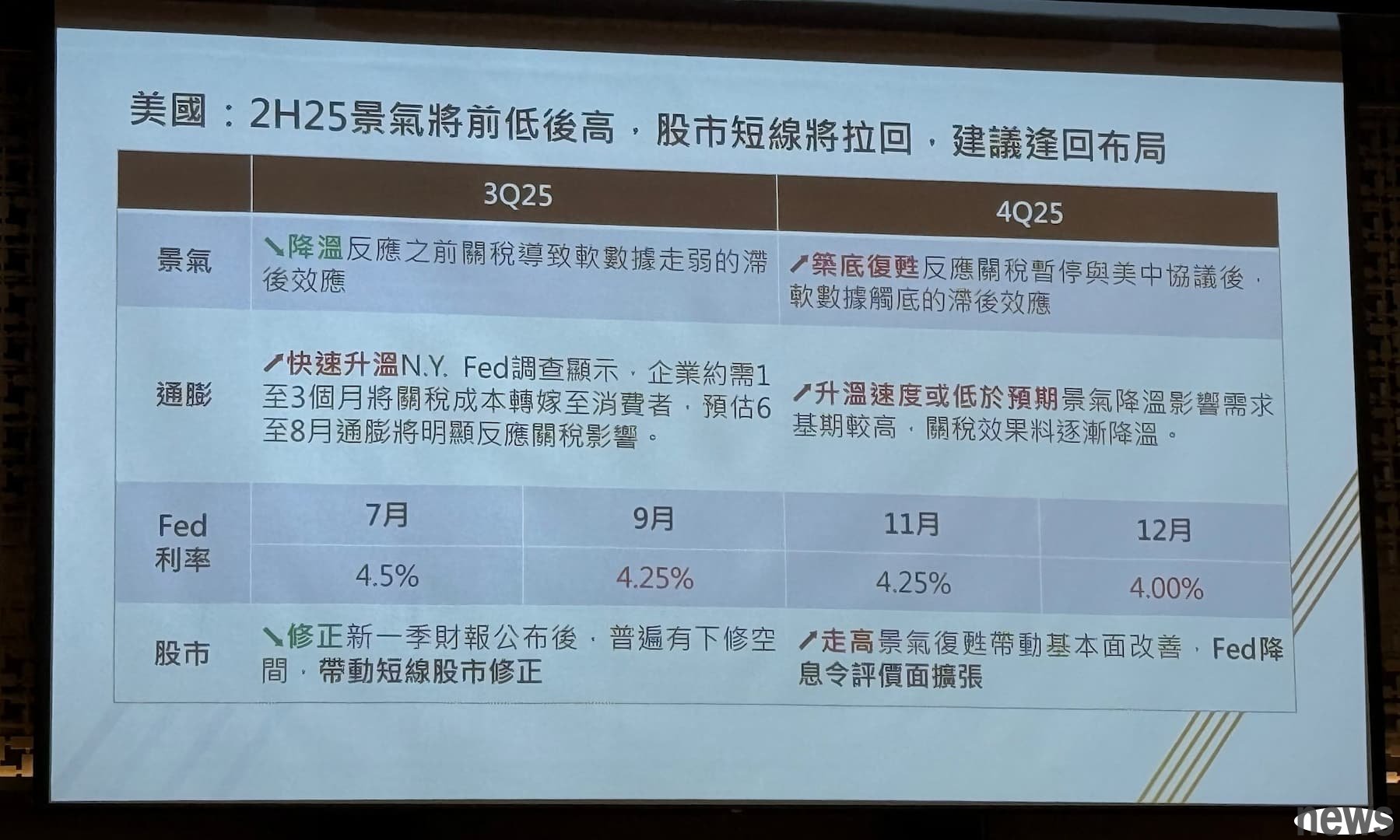

Li Zhenyu shared that this year the investment market has entered a phase of reshuffle and plate reorganization. Trump has set off a new wave of economic and nationalism, which may replicate the tax policy of the Nixon era and cause a striking impact on global trade and supply chains. Taiwan must strengthen its role in the reorganization of supply chains, especially industries that are consistent with the US strategic direction. As for the US dollar system, the US dollar system may face the Triffen dilemma and accelerate the promotion of the US supply chain de-Singapore.

Xi Jinhe, chairman of Financial News Media, said that in recent years, international capital flows have been increasingly affected by geopolitical and institutional risks. From the fluctuations in energy prices extended by the Russian-Ukraine war to the reorganization of supply chains triggered by the US-China technology war, investors cannot rely solely on past experience judgments, but they can enter from the trend of the Taiwan stock market, corporate financial reporting and new industry power, and help investors make more remote layouts.

Xie Jinhe pointed out that the role of Taiwanese companies in the global supply chain is changing rapidly. This is a challenge and an opportunity. Taiwan’s tax rating is 20%, and although it is higher than Japan and South Korea’s 15%, there is no relative condition for a final decision, because the tax rating is a dynamic adjustment process. The most important core of Trump’s tax rating is called DEAL, which means that Taiwan needs to make profits if it wants to talk further, and we must continue to observe the final decision.

Taiwan Xin Investment Credit General Manager Ye Zhujun analyzed that the market is currently moving from expected interest rate cuts to observe the actual economic data. Bond investment should adhere to the law and long-term perspective. It is recommended that investors should focus on the stable returns of bonds, reduce volatility risks through medium- and long-term holding, investment-level debts, and diversified allocations. At the same time, batch entry and regular fixed amount strategies are adopted to balance interest rate uncertainty.

Extended reading: Taiwan tax 20% impacts the three major industries! Legal person: Taiwan Stock Exchange is calm and 232 Terms of refusal Taiwan tax 20% is a temporary tax rate! The Executive Yuan: The two parties continue to discuss and discuss together Terms 232 Taiwan Electric and American factories welcome more profits! Dutch semiconductor equipment factory ASML enjoys zero tax discounts in the United States