The United States launched a 232 chip industry survey in April under the national security name. The tax details have not yet come out, and all semiconductor highly developed countries such as Taiwan are nervous. U.S. Commerce Secretary Lutnik announced today that the results of the investigation will be publicly reported within two weeks.

US President Trump finalized a tax settlement with European Commission Chairman Ursula von der Leyen in Sugarland today, and Howard Lutnick responded to reporters' questions about chip taxes on the spot.

Trump made a statement in February to charge 25% of the tax on imported chips. Two months later, the Ministry of Commerce cited Section 232 of the Trade Expansion Act of 1962 to launch a semiconductor survey.

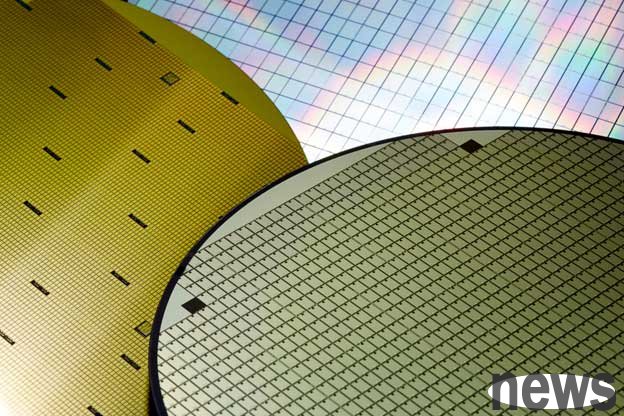

This survey involves a wide range of chip components such as silicon wafer rounds, wafer manufacturing equipment and "downstream products containing semiconductors". The Ministry of Commerce is focusing on "improving the feasibility of domestic semiconductor production capacity" to reduce the dependence on imported products, and whether it is "necessary" to implement tax-related measures in order to protect national security.

The United States highly relies on chips imported from Taiwan, while former President Biden tried to change the situation and once promoted the passage of the "chip bill" to help chip manufacturers expand production in the United States. Taiwan Electric also received assistance in accordance with the law.

After Trump shouted 25% of chip tax levies, he called for "retaining people under the tax levies". The "Information Technology and Innovation Foundation" (ITIF) of the China Intelligent Bank in May estimated that 25% of chip tax levies will reduce the growth of US economy by 0.18% in the first year, and continue to lose 10 years of cumulative GDP to US$1.4 trillion (about NT$41 trillion).

In addition, with a 25% increase in semiconductor costs, the car price may directly rise up to $1,000. The Information Technology and Innovation Foundation estimates that taxes lost due to economic contraction are greater than tax returns.

Zhiku also pointed out that the US government will lose $165 billion in pure taxes as a result; the US per capita living standard will lose $122 in the first year, and the cumulative amount in 10 years will reach $4,208.

In terms of the impact of important industries such as AI and automobiles, Zhiku said that the increase in semiconductor costs will increase the cost of training AI models and weaken the US's competitiveness in the AI field. At the same time, China will continue to vigorously supplement AI and semiconductor industries, so that Chinese companies can expand their AI capabilities without being restricted by the same cost, and have the opportunity to gain a leading position.