According to the latest report from the foreign capital Morgan Stanley, demand for network equipment in data centers continues to be strong, and the life of old memory (such as DDR4) has been extended. In addition, the market may have underestimated the importance of DDR4 data center switches, pushing up the average selling price (ASP). Based on the strong trend, Morgan Stanley raised its target prices on several major memory suppliers.

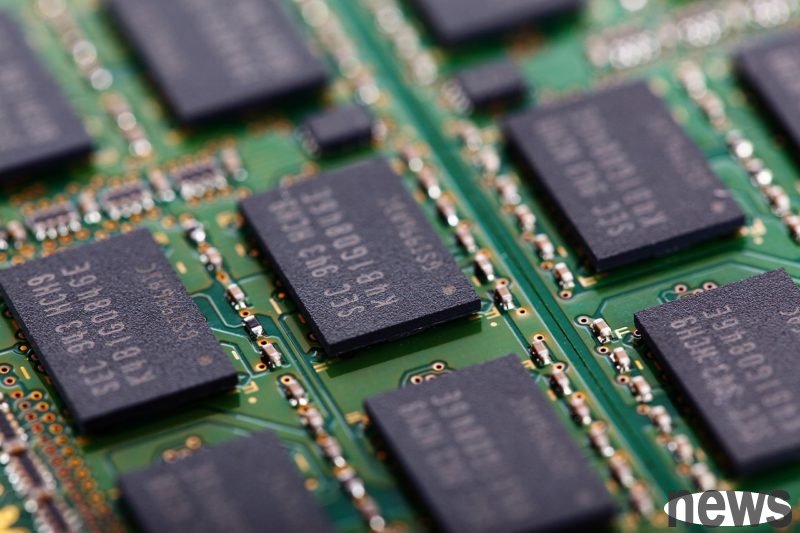

Data centers are a key driver of rising demand for mainstream memory and DDR4. Although DDR5 is a new generation standard, most current network switches, including Nvidia Spectrum and NVlink, still use DDR4. According to the report, switch vendors have not considered migrating to DDR5 as a core focus because DRAM accounts for only a low-single-digit percentage of the switch bill of materials (BOM), which is much lower than the approximately 30% of general servers. Therefore, as long as DDR4 is in supply, manufacturers have no incentive to switch to DDR5. It is expected that this continued demand will bring the DDR4 supply shortage ratio closer to the previously estimated high of 10-15%.

Without DDR4, both GPU and ASIC server racks will not be shipped. Major memory suppliers are gradually withdrawing from the DDR4 market, making Taiwanese manufacturers including Winbond and Nanya Technologies the main beneficiaries. Price increases for DDR3 and DDR4 are expected to continue until 2026.

In addition to DRAM, old NAND memory also shows further room for growth. The report believes that high-density MLC NAND is expected to see an increase in demand in the next six months, especially for suppliers such as Macronix Electronics. As mainstream vendors exit the market, pricing for such products may become very attractive. In addition, with the launch of Nintendo Switch 2, the demand for traditional ROMs is also expected to strengthen.

Based on the above factors, Morgan Stanley’s preferred target is Winbond Electronics. In addition to the better-than-expected financial report, its gross profit margin is expected to reach approximately 43% in September. Coupled with the expectation that memory prices will rise sharply in the fourth quarter, Winbond's gross profit margin is expected to further increase quarterly. Therefore, the investment rating of "Outperform" is maintained, and the target price is raised from NT$50 to NT$65 on the US stock market.

Nanya is the main beneficiary of the DDR4 shortage, and it is expected that the DDR4 shortage will continue until the second half of 2026. Morgan Stanley maintains an "outperform" investment rating and raises the target price from NT$110 to NT$130. In addition, Macronix is expected to start turning a profit from losses in 2026 due to rising demand for NAND Flash and ROM. Therefore, the investment rating of "Outperform" is maintained, and the target price is raised from NT$29 to NT$40.

Moreover, Morgan Stanley also upgraded Power Semiconductor's investment rating to "outperform" due to the price momentum of professional DRAM, although the report slightly lowered its EPS forecast for 2025-27, mainly due to underestimation of depreciation and tepid demand for logic business. The target price was raised from NT$30 on US stocks to NT$35.

Apple estimates that WoW (Wafer-on-Wafer) packaging technology can effectively solve the problems of memory bandwidth and power consumption in AI computing. In addition, Apple's memory business is expected to remain stable in the short term, and the new interface is expected to enter mass production by the end of 2025. VHMStack is expected to accelerate growth in 2027, and IPD (interposer and discrete components) revenue is expected to gradually increase from 2026 to 2027, so the target price was raised from NT$435 to NT$475.